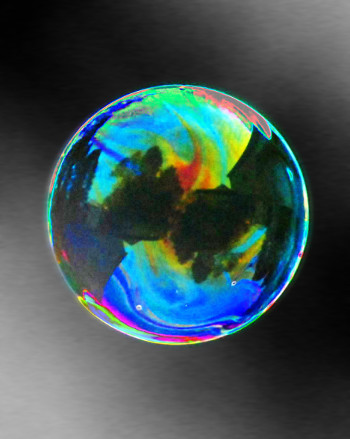

Grantham warns of 'super bubble'

One of the greatest forecasters in global economics sees a bubble about to burst.

One of the greatest forecasters in global economics sees a bubble about to burst.

Jeremy Grantham is a famed investor and co-founder of Boston asset manager GMO.

He has correctly predicted several major market bubbles over the last 50 years, and this week is warning that an historic collapse in stocks he predicted a year ago is under way.

He says the S&P 500 will drop some 45 per cent from Wednesday’s close – and 48 per cent from its January 4 peak – to a level of 2500.

He believes the Nasdaq Composite, already down 8.3 per cent this month, will see an even bigger correction.

“I wasn’t quite as certain about this bubble a year ago as I had been about the tech bubble of 2000, or as I had been in Japan, or as I had been in the housing bubble of 2007,” Mr Grantham said in a Bloomberg interview this week.

“I felt highly likely, but perhaps not nearly certain. Today, I feel it is just about nearly certain.”

Mr Grantham suggests evidence is abundant, dating back to last February when dozens of the most speculative stocks began falling.

He also points to “crazy investor behaviour” as an indicator of a late-stage bubble - a rush to buy meme stocks, a frenzy in the electric-vehicle space, nonsensical cryptocurrencies such as dogecoin and multimillion-dollar purchases of non-fungible tokens, or NFTs.

“This checklist for a super bubble running through its phases is now complete and the wild rumpus can begin at any time,” Mr Grantham said.

“When pessimism returns to markets, we face the largest potential markdown of perceived wealth in US history.”

He has suggested selling US equities in favour of stocks that trade at cheaper valuations in Japan and emerging markets, looking at resources for inflation protection, holding gold and silver, and raising cash in preparation for attractive prices down the line.

“Everything has consequences and the consequences this time may or may not include some intractable inflation,” Mr Grantham said.

“But it has already definitely included the most dangerous breadth of asset overpricing in financial history.”

Print

Print