ASX chief gives data details

ASX CEO Dominic Stevens says the exchange is working on the world's richest blockchain.

ASX CEO Dominic Stevens says the exchange is working on the world's richest blockchain.

Mr Stevens has given an update on the ASX’s planned CHESS replacement project. It is working on a new post-trade system to replace its legacy Clearing House Electronic Subregister System (CHESS) platform, which has been running for around 25 years.

CHESS is the core system that performs the processes of clearing, settlement, asset registration, and some other post trade services which are critical to the orderly functioning of the market.

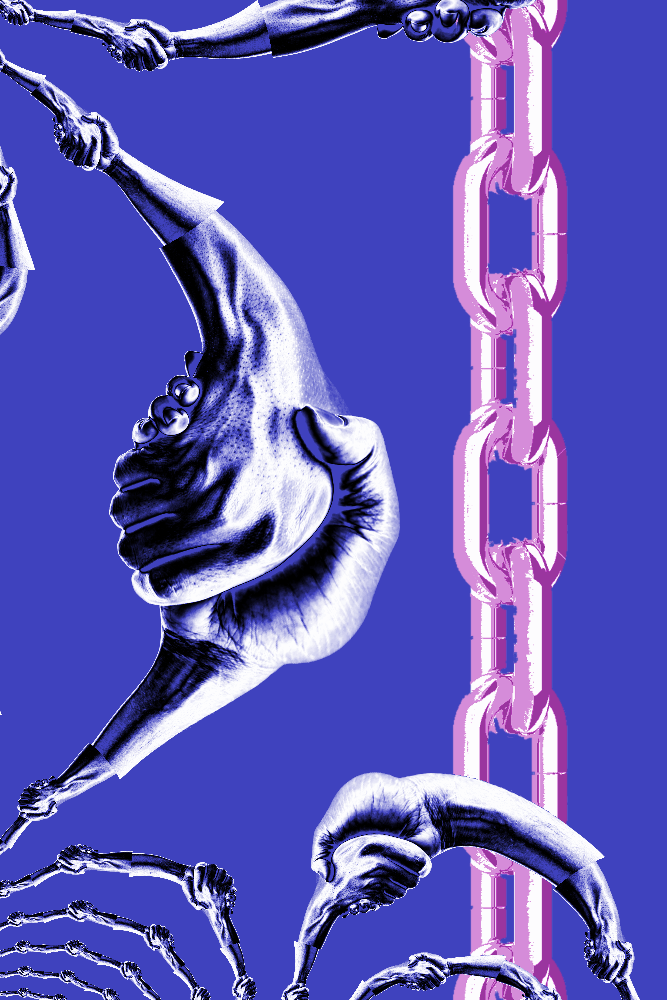

In 2015, ASX launched a process of evaluating replacement options for CHESS, eventually selecting Digital Asset as a technology partner to develop, test and demonstrate to the ASX a working prototype of a post-trade platform for the cash equity market using distributed ledger technology, commonly referred to as ‘blockchain’.

Mr Stevens said it is a once-in-two-decade technology shift, but he is in the new private, “permissioned” system.

The ASX’s Digital Asset blockchain will be available only to equity market participants, and even they will have to learn a particular programming language to use it.

But even so, Mr Stevens says it will dwarf bitcoin, ethereum and all other cryptocurrencies.

The complete crypto market capitalisation this week was about US$1.3 trillion (AU$1.7 trillion).

“We are moving two to three trillion dollars of securities on to this system and that is larger than the whole global crypto world is sitting on the blockchain,” Mr Stevens said.

The ASX is looking at governance principles aligned to public blockchains.

Mr Stevens said “everyone can come in and collaborate” at the ASX “Australian liquidity centre”, to “make that a more collaborative ecosystem of data, rather than just ASX’s data”.

He said the ASX’s data strategy is “less about how ASX interacts with a customer and more about how the ecosystem interacts with itself”.

Mr Stevens said that for the Australian equity market, “when you go to a distributed ledger, what you are going from is a unilateral with me to a multi-lateral relationship with the market”.

Under the old CHESS system, data moved on a bilateral relationships basis, and so market participants dealt with ASX. But with the new system, “you will know everyone else is synced at that same level”.

“What that means is, we are all in sync on an immutable ledger. It’s all in real time. And the beauty of it is smart contracts are being built on top of that, so you have the same data structures ... It allows not just ASX, but the market, to go forward and build things on top of this.”

Print

Print