When the roof catches fire, the US may have no water

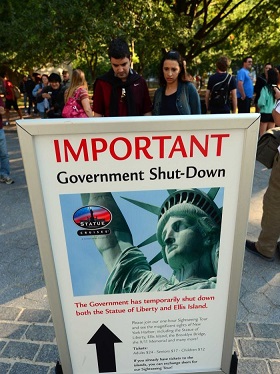

As the United States prepares for its fourth day of a stoush over healthcare funding that has shut down the country, experts are trying to quantify the effect it will have on various sectors.

As the United States prepares for its fourth day of a stoush over healthcare funding that has shut down the country, experts are trying to quantify the effect it will have on various sectors.

US president Barack Obama has intervened on the government shutdown stand-off several times, hosting negotiations which have so far led to virtually progress. Mr Obama words to members of congress has now become more blunt;

“My simple message today is; call a vote,” he said.

“Take a vote. Stop this farce, and end this shutdown right now.”

Reports say the stand-off and shut-down look like dragging on into mid-October, with neither side conceding any ground so far. Among the proposals in the stymied argument has been for the signing of a series of small bills to fund and re-open the most visible US Government services such as the Smithsonian Museum.

Nearly a million federal government workers have been sent home or asked to work without pay for the entire week. Companies dependant on federal workers to inspect and approve their products or on government money to fund their operations are now facing the effects – with several planning to slow or stop work next week.

Financial analysts say while the shut-down costs around $300 million per day and will see a series blow dealt to the finances of government employees, it pales in comparison to the possibilities surrounding and upcoming decision to raise the debt ceiling.

Mere talk of raising the ceiling in 2011 saw the US stripped of its AAA borrowing rating and led to one of the worst days ever for the Dow Jones. Now there is a scheduled reinvestigation of the United States’ need to increase borrowing levels to make up for its gap in expenditure and revenue.

Some analysts say if the shut-down is still in place when debt ceiling talks kick off again, the issues could merge and become compounded into a mega-issue.

A similar stoush unfolds over the decision to raise the debt ceiling – speculators suggest the United States could default on its loans and possibly be plunged back into recession.

The stand-off continues.

Print

Print